The Data Handbook

How to use data to improve your customer journey and get better business outcomes in digital sales. Interviews, use cases, and deep-dives.

Get the book.jpg?width=1500&name=Banner_SalesEfficiency_2_Blue%20(1).jpg)

As one can imagine, the impact of COVID-19 on digital sales and marketing has been significant, and it has caused permanent changes to the ways companies will operate digital sales and marketing in the future. But how exactly has consumer behaviour changed during COVID-19? How has the pandemic affected companies' sales, and which industries have been affected the most? How are other companies fighting back this situation and what successes have they achieved so far?

There’s a vast amount of questions on every decision maker’s lips regarding the effects of the pandemic, and what is the correct course of action to ensure business success in the future. Together with the help of 100 decision makers and over 1000 consumers, Columbia Road was able to conduct a market research that offers insights into how COVID-19 has impacted consumers and companies, and how decision makers are planning to conquer current challenges.

The research consists of two parts: (1) consumer survey conducted in Finland through Kantar international, and (2) a survey for Nordic digital sales and marketing leaders, complemented by 12 in-depth interviews.

We have divided the findings of our research into two blogs. In this blog, we will go through how COVID-19 has impacted online consumer behaviour and businesses so far. In the second blog, we discuss what this change means for businesses and what are the key things to focus on in order to win back sales.

Consumer behaviour – permanent increase in online purchases

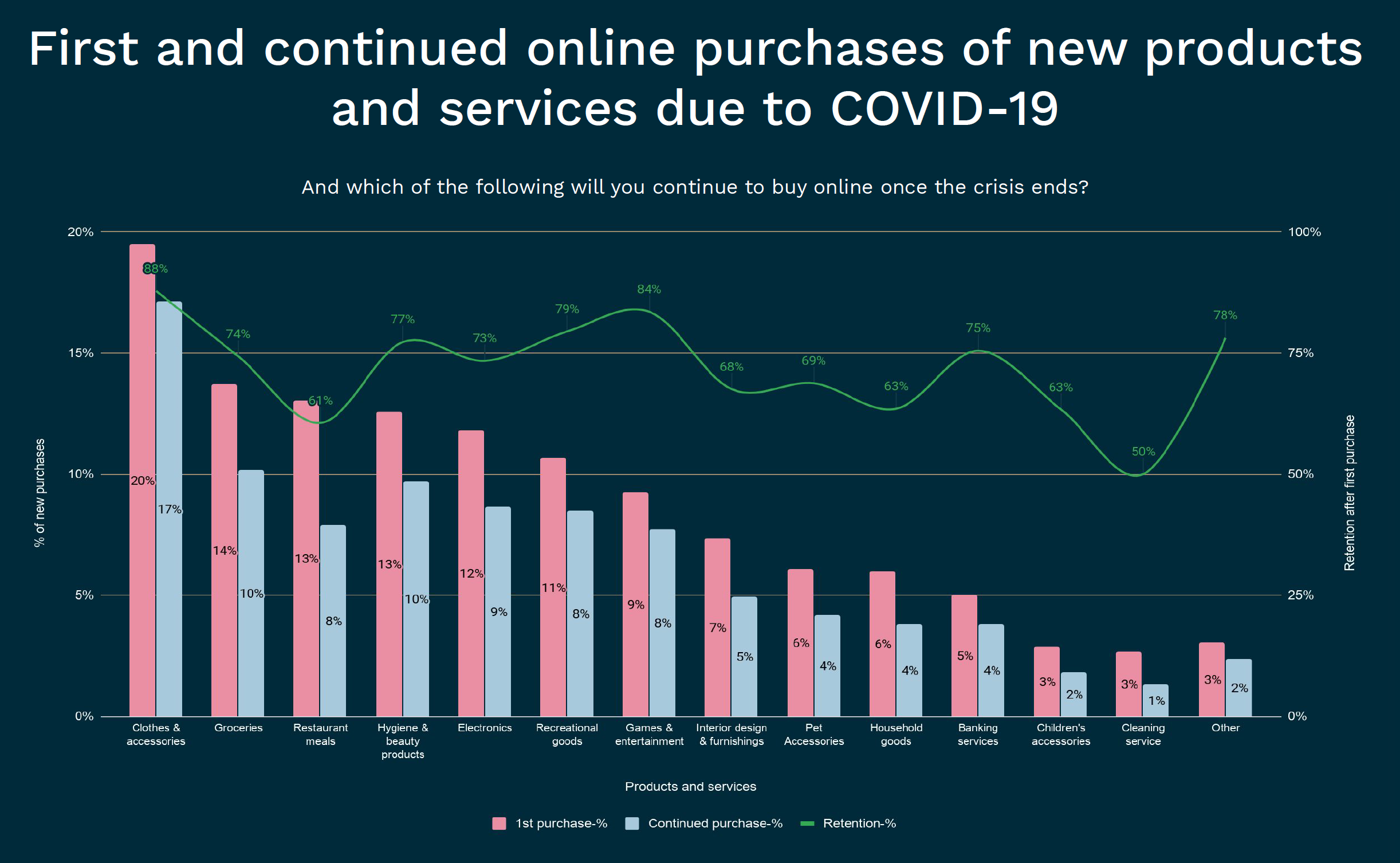

The consumer survey results reveal a significant change in consumer behaviour in Finland. According to the results, 55% of consumers have bought products that they have not purchased online before due to COVID-19. Of these consumers 73% reported that they are also planning to continue buying these products and services online after the COVID-19 situation normalises.

Understandably, due to COVID-19, the daily essentials — such as clothes, groceries, meals and hygiene products — are the most sought-after goods online for first-time buyers. As much as 20% of consumers have bought clothing items online for the first time during the pandemic, and 88% of them are also planning to continue purchasing clothing items online. Buying clothing items for the first time online seemed to be common especially for families with children.

On the other hand, although 13% of consumers made their first online restaurant meal purchase, this group seemed the least likely to continue online purchasing after the pandemic, as 61% of them reported to continue purchasing.

As consumers now have more free time, they seem to be looking for ways to spend it. After daily essentials, the most sought after goods were electronics, games & entertainment, recreational goods, and interior design and household goods. The study also supports gender stereotypes: Men, for example, buy more electronic goods and women buy more health and beauty products.

COVID-19 effects on B2C vs. B2B businesses

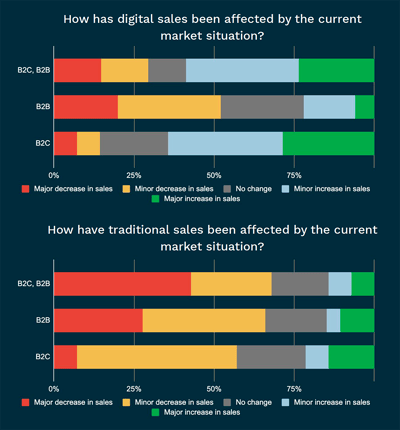

It is safe to say that for B2C, COVID-19 has caused a decisive turn to an ecommerce-first approach. Due to consumers increased interest towards online shopping, 64% of B2C companies have reported an increase in their digital sales and only 14% have reported a decrease in digital sales. Although 57% of B2C companies report that their traditional sales have decreased, their overall sales might have stayed unaffected or even increased, since consumers are clearly making up for the lack of traditional shopping in online sales channels.

“We only dreamed of such growth in sales, and then it happened overnight. We've reached new audiences and sales have been growing steadily.”

– Growth Manager, Small B2C company

Which companies seem to have suffered the most then? The current market situation has decreased the sales of B2B companies the most, as 52% of B2B companies report a decrease in digital sales and over 70% report a decrease in traditional sales. It seems that B2B businesses are more susceptible to changes in their operating environment

and thus, businesses have decreased or prolonged investments in order to be cautious of a possible economic downturn.

Companies that operate both in B2B & B2C markets, fall somewhere between the two ends of both worlds. As consumers have increased their online buying, almost 60% of companies operating in both B2B & B2C markets have reported an increase in digital sales. On the other hand, as both consumers and businesses have decreased their traditional buying, nearly 68% of B2B & B2C companies have reported a decrease in traditional sales.

“Digitalisation and online buying have taken a two-year leap forward in just a few months. We are reaching a point where consumers can’t imagine not being able to shop and run daily errands online.”

– Sales Manager, B2B & B2C company

Regardless of the marketplace or target audience, digital sales has undoubtedly been “carrying the ball”. The shift in the market place has provided significant momentum and push towards digital ways of selling and marketing.

COVID-19 effects on large, mid-sized and small businesses

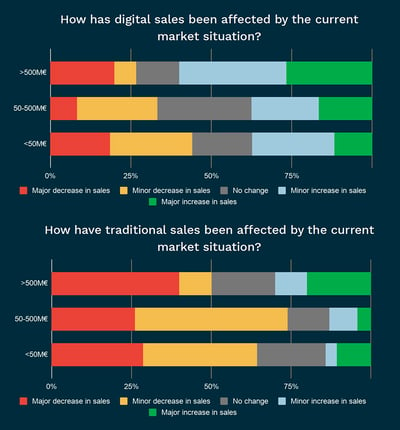

Large companies have been enduring the crisis better than the smaller ones. 50% of large companies reported a decrease in traditional sales, yet over 60% of large companies also reported an increase in digital sales. The reason might be due to their more diverse portfolios or presence in both B2B and B2C markets.

Surprisingly, mid-sized companies were most negatively affected in traditional sales with almost 74% of respondents reporting a decrease. However, only 33% of respondents reported a decrease in digital sales and nearly 38% reported an increase. This might indicate that mid-sized companies have stronger digital capabilities to support sales, and that their B2B sales might be relying too much on traditional sales.

Small companies were the most affected by COVID-19 in digital sales. 44% reported a decrease in digital sales, while 64% reported a decrease in traditional sales. The decrease in sales might be caused by small companies’ lack of resources for digitalising and automating sales processes compared to bigger companies.

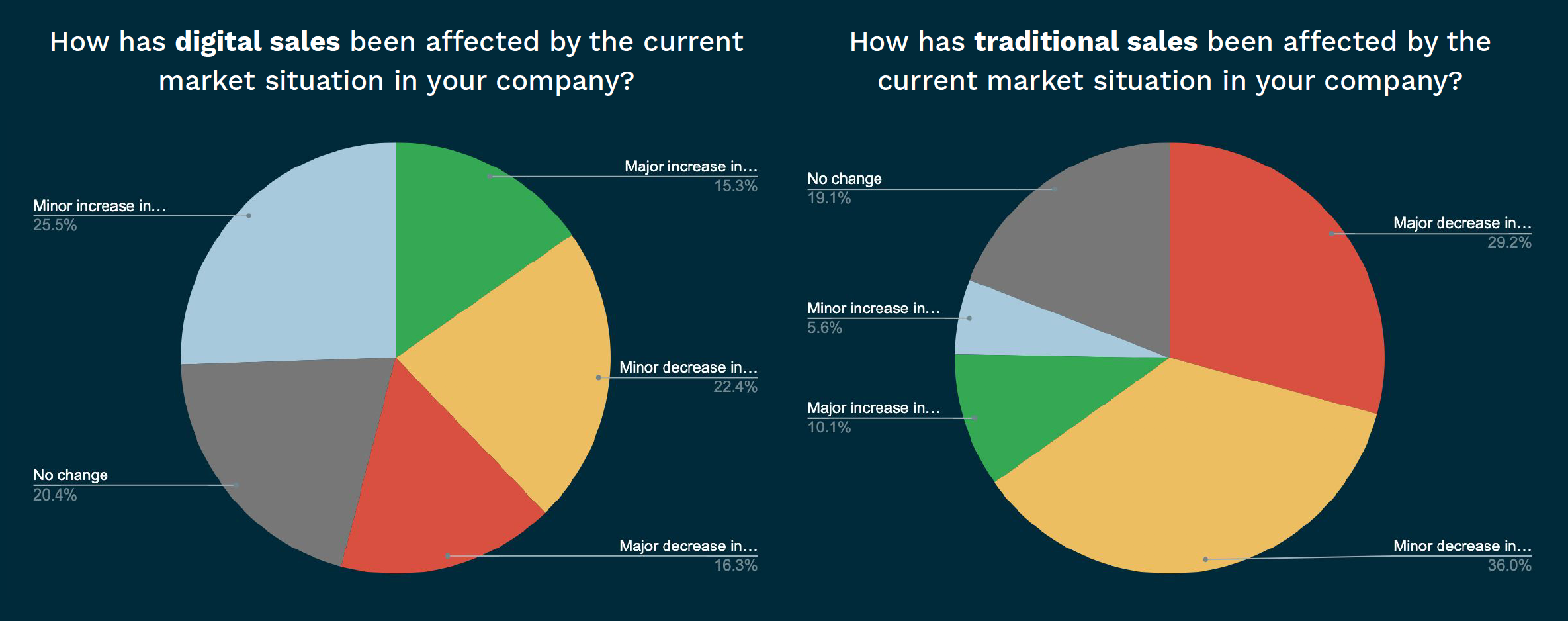

Impact of COVID-19 on digital sales – Summary of all companies

- 41% of respondents stated that there has been an increase in digital sales

- For 15% the increase has been major

- 16% reported an increase in traditional sales

- ⅕ of respondents considered their digital and traditional sales to be unaffected

- 39% stated that there has been a decrease in digital sales

- 65% saw a decrease in traditional sales

- The increase in digital sales has been higher within B2C than in B2B

Regardless of the business focus or size, the respondents strongly feel that new ways of selling and marketing are here to stay and that the new normal needs adjusted digital sales and marketing efforts. Moreover, the focus of improvements and investments need to be reconsidered. Due to the rise of digital, now more than ever, digital sales can have an increased impact on established company value.

“The new normal will not be as it used to be. There is no way back to the old ways of working.”

– Large B2B & B2C company

Read the second part of this blog to find out the key actions to take in order to recover and to win back sales in the new business environment. Or download the whole market research report to understand the effects of COVID-19 and what digital sales & marketing leaders think to be the key things to focus on in the future.

This blog was written together with my amazing colleague Olivia Helle.

The Data Handbook

How to use data to improve your customer journey and get better business outcomes in digital sales. Interviews, use cases, and deep-dives.

Get the book