The Data Handbook

How to use data to improve your customer journey and get better business outcomes in digital sales. Interviews, use cases, and deep-dives.

Get the book

Companies often state they’re customer-centric, but a quick look under the hood quite often reveals spurious activities that are far from actual customer-centricity. Companies might use customer-base-wide averages to form their strategy on and end up trying to feed a generic brand message to all their customers, or they might be valuing each customer’s opinion equally disregarding customer heterogeneity, and that not all customers’ feedback simply is as valuable as some others’.

In reality, all customers are different, and no customers are created equal. Some customers are good, some are worse, and there’s only so much a company can do to try to turn the less valuable customers into better ones. Some customers are bargain hunters, and some just spend more on average, without an excessive need to nurture the relationship. The solution is to try to optimise the business based on the needs of those customers, who’ll likely be the ones bringing in the most profit in the long term. On top of only being able to retain those customers, it evidently means to be able to locate them and to acquire them.

Find your future best customers

The future best customers are the ones with the highest customer lifetime value (CLV). Customer lifetime value can be considered the present value of all variable profits and costs attributed to a customer, including customer acquisition cost. To put more simply, it’s the customer’s historic and future revenues subtracted by all the costs attributed to the customer.

Essentially, it is an estimate of the customer’s value to the company, and it can tell us whether it turned out to be profitable to acquire the customer or not and by what margin. Here, the important thing is to understand that the concept of CLV is predictive, and not simply a historic value. CLV takes into account the potential future purchases of customers.

Do you have an understanding of your customers' CLV?

Understanding CLV on an individual level is something every company should try to strive toward. For instance, having an estimate of CLV on individual level enables companies to divide customers into groups based on their actual value to the company. This is a wonderful help in decision-making, as it becomes easier to allocate resources to nurture the high CLV customers and to free resources from activities that likely will not turn relationships profitable in the long run.

Additionally, CLV can act as an upper bound for customer acquisition cost, as you surely would want for the customer relationship to be profitable. Also, the sum of CLVs can even act as a proxy for the valuation of a business. If one thinks about it, a business is only as valuable as the future cash flows of all the customers (on top of the cash flows of the yet-to-be-acquired customers).

"A business is only as valuable as the future cash flows of all the customers"

Customer-centricity does not mean that every customer is important

Understanding CLV is mandatory for practising a customer-centric strategy. Customer-centricity is a probability game, where companies try to invest in the customers who’ll bring in profits even years after the acquisition. If you knew the CLV of all your customers, is there something you would do differently?

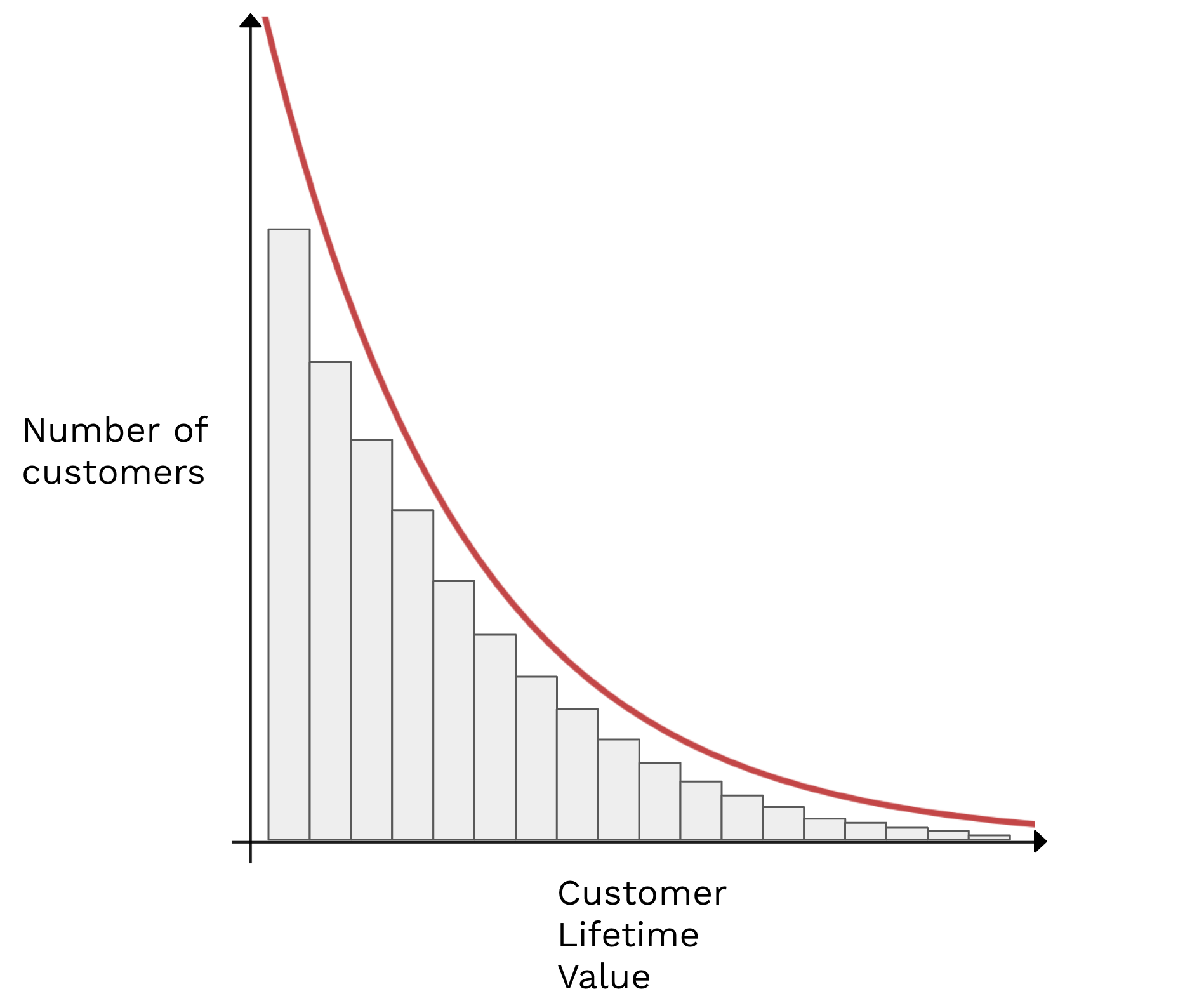

The difficulty of acquiring future best customers lies in the fact that only a fraction of acquired customers will actually have a relatively high CLV. Generally, the Pareto principle applies in the profit distribution of customers, meaning that “20% of customers bring in 80% of profit”. Many times the distribution is even more exaggerated, as in some businesses 1% of customers may bring in 99% of profit.

Generally, this is what the value distribution of customers look like: there are very few high CLV customers (on the right), as opposed to the low CLV customers (on the left).

To be able to acquire the future best customers, the company must have an idea where they’re found. When finally locating these customers, the acquisition efforts should be very targeted and done with a quality-first mentality. However, the more precise and targeted marketing is, the more expensive it also tends to be. Therefore, broader customer acquisition must also be exercised to fund the more expensive and targeted marketing.

Finding the balance boils down to how much the company wants to put effort into finding the best customers. The more the company does targeted marketing, the more it needs the steady flow of smaller profits from the customers acquired from the broad acquisition campaigns.

It's a marathon, not a sprint

The fact is, optimising a business based on customer lifetime value is a marathon, not a sprint. The payback period for an acquired customer might be long and the customer relationships may turn profitable after months, or even years after the acquisition. Hence, a company needs less profitable customers that bring in short-term profits to fund the evolution of more expensive high CLV customers.

Theta Equity, a company valuing businesses based on publicly available data, mention in their article on Slack’s unit economics that the average buyback period for a Slack customer is a staggering three years. As the average CLV forecast of Slack customers is highly positive, this is a prime example of a customer-centric acquisition strategy that might seem like a miss at first, but will most likely pay off in the long run. Notable is that while 1% of Slack customers have an estimated post-acquisition value of $4.9M, it’s only $56K for the rest of 99% of customers. This is an extreme case of observed customer heterogeneity. It’s clear where Slack should be focusing most of their efforts.

Five ways to bring CLV into your toolkit right now

Whether you’re reading this as a manager of a B2B subscription business, or a marketing director of a B2C fashion brand, there are key takeaways you can take into your daily toolkit, and they are as follows:

- Customers are not equal. Businesses should be optimised based on customers with the highest customer lifetime value (CLV).

- Customer lifetime value is an estimate of the customer’s present value to the company, thus including all the historic and future costs and profits attributed to the customer.

- There are very few future best customers compared to less profitable ones

- Companies need broad customer acquisition to fund the more expensive targeted acquisition that aims to find customers with high CLV

- Customer acquisition is a marathon. It might take a while for customer relationships to turn profitable.

We organised an exclusive CLV and customer-centricity event together with University of Pennsylvania in Stockholm on September 9th 2019. The event was hosted by Peter Fader, who is a leading expert in the field.

The Data Handbook

How to use data to improve your customer journey and get better business outcomes in digital sales. Interviews, use cases, and deep-dives.

Get the book