The Data Handbook

How to use data to improve your customer journey and get better business outcomes in digital sales. Interviews, use cases, and deep-dives.

Get the bookAll companies should aim to acquire customers with the highest lifetime value. But to fund the marketing efforts needed for finding them, revenue from less profitable customers is needed too. It’s a balancing act that’s tough to get right.

Companies often say they’re customer centric, but a quick look under the hood quite often reveals activities that are far removed from customer centricity. A company may use customer-base-wide averages to form its strategy, then subsequently try to feed a generic brand message to all its customers. Or it may disregard customer heterogeneity and value every customer’s opinion equally, when in truth not all customer feedback has the same value.

Companies often say they’re customer centric, but a quick look under the hood quite often reveals activities that are far removed from customer centricity. A company may use customer-base-wide averages to form its strategy, then subsequently try to feed a generic brand message to all its customers. Or it may disregard customer heterogeneity and value every customer’s opinion equally, when in truth not all customer feedback has the same value.

The reality is that all customers are different, and no customers are created equal. Some customers are good, some are worse, and there’s only so much a company can do to try to turn the less valuable customers into better ones. Some customers are bargain hunters, and some just spend more on average without an excessive need for the relationship to be nurtured.

The solution is to try to optimise a business based on the needs of those customers who will likely be the ones bringing in the most profit over the long term. This means locating them, acquiring them and retaining them.

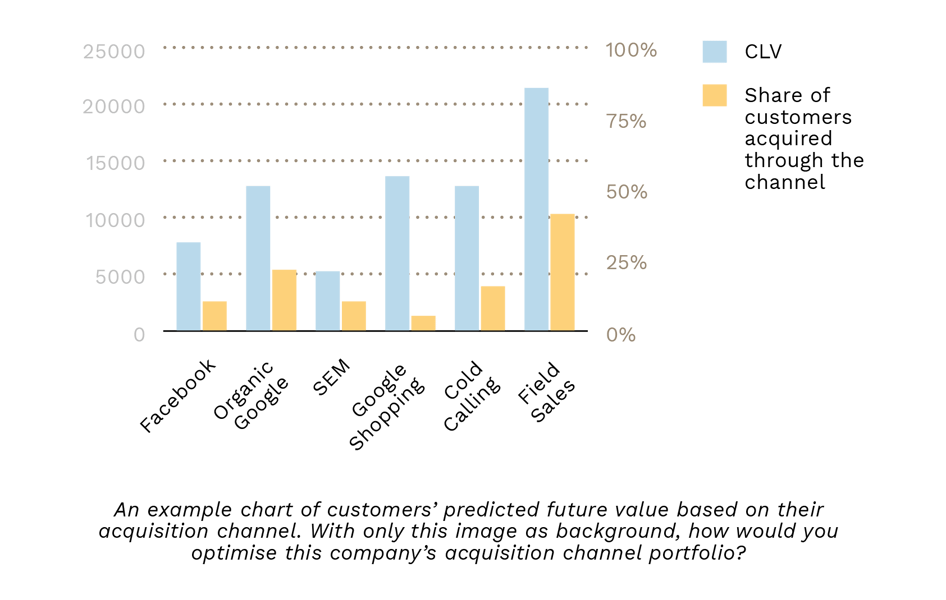

In the end, it all boils down to the kind of customers that companies are able to acquire in the first place. So instead of focusing on cutting costs by minimising cost per acquisition (CPA), companies should focus on maximising value per acquisition (VPA). If companies are able to acquire the customers that will stick with them in the long run, customer retention and development activities suddenly become much easier.

Find your future best customers

Your future best customers are the ones with the highest customer lifetime value (CLV). This is defined as the present value of all variable profits and costs attributed to a given customer, including their acquisition cost. To put it simply, it’s the customer’s historical and future revenues, minus all costs attributed to the customer.

CLV not only shows you whether it was profitable to acquire a given customer, but also by what margin. The important thing to understand is that the concept of CLV is predictive; it is not simply a historical value, as it takes into account the potential future purchases of customers too.

Do you understand your customers’ CLV?

Understanding CLV at the individual customer level is something every company should strive to do. It is imperative when practising a customer-centric strategy. If a company has no idea of the predictive CLV of their customers, how can they tell who their future best customers are?

Estimating CLV at the individual customer level enables companies to divide customers into groups based on their actual value to the company. This is extremely helpful in decision-making, as it becomes easier to allocate resources towards nurturing high CLV customers, and free up resources from activities that are unlikely to yield profitable relationships in the long run.

CLV can also help to determine a ceiling for the costs of acquiring a customer, as no company wants an unprofitable customer relationship. The sum of CLVs can even act as a proxy for the valuation of a business, as a company is only as valuable as the future cash flows of all its customers (on top of the cash flows of its yet-to-be-acquired customers).

Customer-centricity does not mean that every customer is important

Customer-centricity is essentially a probability game. Companies try to balance between investing heavily in customers who are profitable over the longer term, customers who are profitable in the short- and mid-term, and avoiding acquiring the wrong customers in the first place. This balancing act isn’t easy and many companies never get it right.

The difficulty of the balancing act lies in the fact that only a fraction of acquired customers will actually have a relatively high CLV. In other words, there are usually only a few future best customers. The Pareto principle generally applies in the profit distribution of customers, meaning that 20% of a company’s customers bring in 80% of its profit. Often the distribution is even more exaggerated, with 1% of customers bringing in 99% of profit for some businesses.

To be able to acquire its future best customers, a company must first have an idea of where to find them. Once they're located, acquisition efforts should be very targeted and done with a quality-first mentality. But the more precise and targeted marketing is, the more expensive it tends to be. This is why broader customer acquisition efforts must also be done, as you need a wide base of customers to fund the more expensive and targeted marketing needed for attracting future best customers.

Finding the balance boils down to how much effort a company wants to put into finding its best customers. The more targeted the marketing a company does, the more it needs the steady flow of smaller profits from the customers it acquires through broad acquisition campaigns.

It's a marathon, not a sprint

When it comes to digital sales, we often look at short term metrics like cost per acquisition (CPA). This is partly because CPA is easily measurable, and partly because it provides companies with actionable insights. It’s easy to set goals and create marketing strategies behind such a simple metric.

Most analytical tools report CPA. And rightly so; it's an important metric as there’s a limit to what a business can afford for acquisition. However, CPA should not be the main driver for a customer acquisition strategy, as there's much more upside potential in maximising value per acquisition (VPA) than in minimising CPA. Although VPA is more difficult to measure, a business that maximises this metric will solve many of the challenges that come with managing customer relationships.

Optimising a business based on CLV is a marathon, not a sprint. And this is exactly what makes it harder than short-term optimisation. The payback period for an acquired customer may be long, and the customer relationship may only turn profitable months (or even years) after the acquisition. Hence, a company needs to have customers with low CPA too, in order to bring short-term profits that fund the nurturing of more expensive high-CLV customers until they become profitable.

Five things to know about customer lifetime value (CLV)

Whether you’re managing a B2B subscription service, a B2C fashion brand, or any other kind of business, there are five key things to remember about CLV:

- All customers are not created equal. Businesses should be optimised based on customers with the highest customer lifetime value.

- Customer lifetime value is an estimate of the customer’s present value to the company, including the historic and future costs and profits attributed to that customer.

- There are relatively few future best customers, and many less profitable ones.

- Companies need broad customer acquisition efforts. The less profitable customers can fund the high costs of targeted acquisition efforts aimed at finding customers with high CLV.

- Customer centricity is a marathon. It may take a while for customer relationships to turn profitable, which makes optimising for CLV harder than optimising for shorter term metrics such as cost per acquisition (CPA).

We organised an exclusive CLV and customer-centricity event together with University of Pennsylvania in Stockholm on September 9th 2019. The event was hosted by Dr. Peter Fader, who is a leading expert in the field. Read his top lessons of CLV below.

The Data Handbook

How to use data to improve your customer journey and get better business outcomes in digital sales. Interviews, use cases, and deep-dives.

Get the book